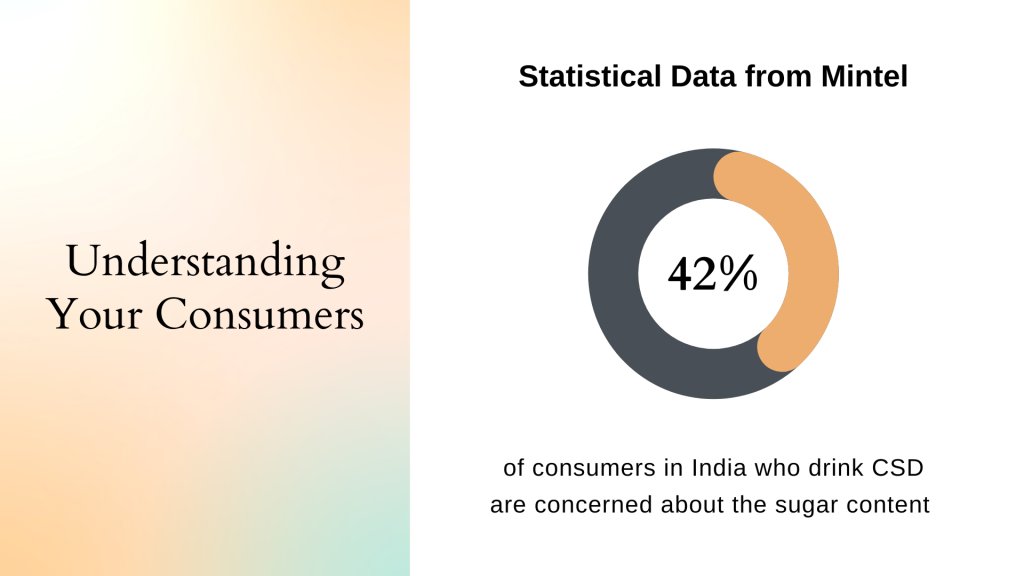

Do you know what is the top concern of Carbonated Soft Drink (CSD) consumers in Asia?

Sugar content.

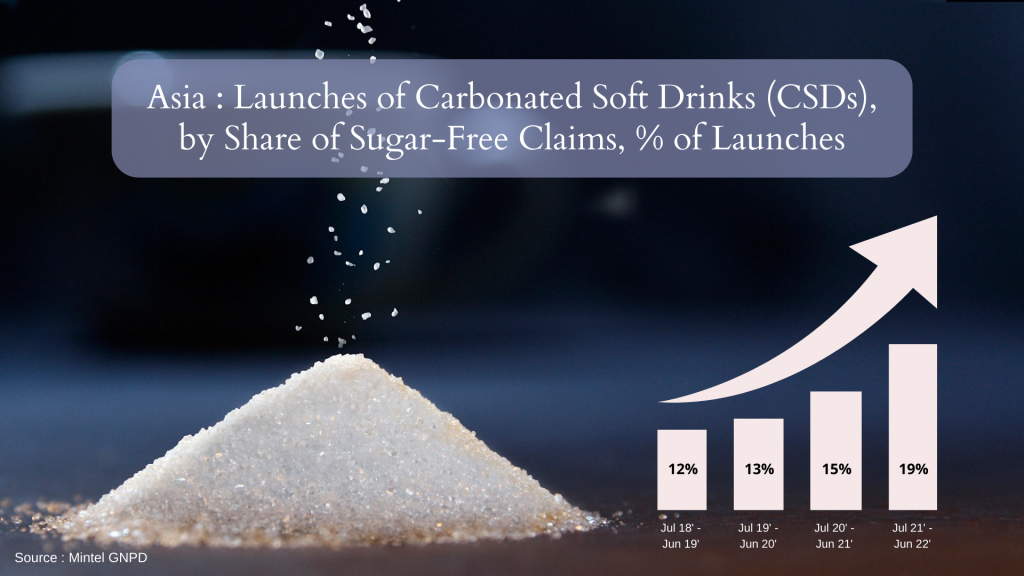

In fact, not only in India, sugar reduction warrants more attention in CSD innovation in Asia. Consumers anticipate for new CSD launches with sugar-free claims in order to fix their cravings.

The increasing availability of lower and non-sugar alternatives in the market can be due to the growing consumer awareness of sugar-related health concerns and sugar tax enforcement that many countries have implemented or explored to some extent over the past few years. Here is the latest information of sugar tax on Sugar Sweetened Beverages (SSB) in the ASEAN countries;

Malaysia

Implemented since July 2019

RM 0.40 per litre tax on1

– Carbonated, flavoured and other non-alcoholic drinks with >5g total sugar per 100ml

– Fruit or vegetable juices with >12g total sugar per 100ml

Latest update2

– The 2022 budget announced that the scope of Excise Duty on Sugar Sweetened Beverages will be expanded to include premixed preparations of chocolate or cocoa based, malt, coffee and tea such as 2 in 1 or 3 in 1 premixed beverage, effective 1 April 2022

– However, on 31 March 2022, the Royal Malaysian Customs Department (“RMCD”) announced that the implementation of Excise Duty on premixed beverages has been postponedto a later date to be announced

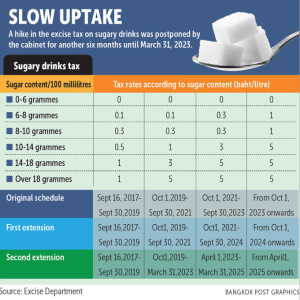

Thailand

Implemented since September 2017

3-tiered ad valorem & excise taxes3

– Applicable on all drinks with >6g sugar per 100ml

– Ad valorem rate will decrease over time as excise increases (up to 5 baht/L ($0.15) for drinks with >10g sugar/100mL

Latest update

– Finance Minister Arkhom Termpittayapaisith stated that the cabinet agreed to postpone the planned increase in the excise tax on sugar-based sweeteners to March 31, 2023, from Oct 1, 2022

Indonesia

Latest update4

– In 2022, Indonesian government is proposing to impose excise on Sugar Sweetened Beverages (SSB)

– No further confirmation on when the actual implementation will take place

Vietnam

Implemented since August 2022 (until June 2026)

Latest update5

– Vietnam imposes 47.64% anti-dumping tax on sugar imports originating from Thailand

– Sugar products imported from Cambodia, Indonesia, Laos, Malaysia, and Myanmar using Thai sugar materials will also be imposed the same anti-dumping tax

– The Ministry of Industry and Trade stated that “If they can prove that sugar imported from these five countries is produced from domestically-grown sugarcane, their sugar products will not be subject to safeguard measures”

Philippines

Implemented since January 2018

As mandated under Tax Reform for Acceleration and Inclusion (TRAIN) Law;

i) 6 pesos per litre on sweetened beverages

ii) 12 pesos per litre on beverages with high-fructose corn syrup

Latest update6

– From 2024 onward, the law mandated that the tax rate increase by five percent yearly or based on the recommendation of the finance chief

Sugar-free CSD launches continue to gain share as producers meet consumer interest in better-for-you recipes. Additionally, nutritional claims can further improve the permissibility of CSDs. Brand owners can innovate further to use CSDs to deliver functional health benefits in order to improve immunity, enhance relaxation and more.

References

- https://nutrition.moh.gov.my/en/the-implemention-of-taxation-on-sugar-sweetened-beverages-ssbs-in-malaysia/

- https://home.kpmg/my/en/home/insights/2022/04/postponement-of-implementation-of-excise-duty-on-premixed-beverages.html

- https://www.bangkokpost.com/business/2396386/sugary-drink-makers-get-tax-reprieve

- https://www.globalcompliancenews.com/2022/07/14/indonesia-indonesian-government-is-proposing-to-impose-excise-on-sugar-sweetened-beverages-29062022/

- https://vietnamnet.vn/en/vietnam-imposes-safeguard-duties-on-sugar-products-from-five-more-countries-2045806.html

- https://www.philstar.com/business/2022/05/03/2178287/p105-million-taxes-collected-sugar-laced-drinks

This information is brought to you by ITS Nutriscience. For enquiries, feel free to contact us!